Responsible investment :

Responsable Investments

Responsible investments generally passes through filters called ESG.

Environnemental

Climatic changes, ressource management and infrastructure.

Social

Demography, work, education, inequality, foresight.

Governance

Independance, balance of power, code of conduct, business ethics, transparence.

2020 was a pivoatal year revealing a massive trend towards the world of responsible investments. It’s up to you to jump on this opportunity!

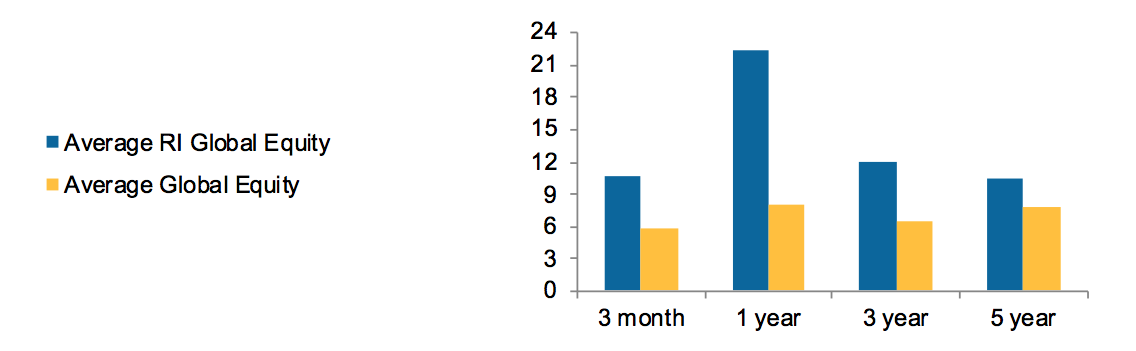

Report on RI funds – Global Equity

- 130 coutries have made or are considering making commitments to achieve carbon neutrality and will need to invest heavily to reduce their emissions (Sources : OCDE, Global Commission on the Economy and the Climate, Energy and Climate Intelligence Unit, Vivid Economics.)

- US$ 6.9 trillion per year must be invested each year in clean energy infrastructure to meet the decarbonization targets set by the Paris Agreement (Sources : OCDE, Global Commission on the Economy and the Climate, Energy and Climate Intelligence Unit, Vivid Economics.)

- US$ 26 trillion in direct economic benefits could be generated by climate initiatives by 2030 (Sources : OCDE, Global Commission on the Economy and the Climate, Energy and Climate Intelligence Unit, Vivid Economics.)

- According to the latest available data, RI assets grew from $ 2.1 trillion at the end of 2017 to $ 3.2 trillion as of December 31, 2019. This represents a 48% increase in assets under management of the IR over two years (Source : AIR Report, November 2020)

- A growing body of research indicates that women in leadership positions or on the board of directors of a company have a positive impact on company performance (Source : Condition Féminine Canada (2016).

- Transparency on the part of managers brings your investments more stability by reducing potential scandals related to these companies in which your funds are invested.

- Responsible investing mutual funds have demontrated strong financial performance : more than three-quarters of responsible funds have outperformed the average return by asset class.